skip to main |

skip to sidebar

- Amazing...

- I'm an absolute nobody in a vast world of billions. Yet, I've touched folks that I'll never meet (ie, red dots) via the internet.

- Let me hope that there has been a positive impact.

- I'm humbled to participate in this worldwide community with a free exchange of ideas, unimaginable to me as recent as a few years ago.

- May God bless you all!

- I honestly believe that we share the same values, despite cultural differences, and seek truth. That is our bond, no matter where we live.

- Thank you for visiting.

- At top, the single best graphic that I've seen portraying the US Federal Budget problem (FY 2010). It makes the problem soooo easy to visualize. Immediately beneath that, the breakdown of federal taxes by source. A lot of people have no idea how much they pay in payroll taxes compared to income taxes. Politicians love this...as long as you don't understand your taxes, they are safe! And, THAT, my friends is why they'll never simplify the tax code.

- Basically at current tax levels, we're able to cover Social Security, Other, Medicare, Medicaid and Interest on our debt. But we can't cover anything else....at all! Think about that. That is absolutely insane.

- Some will argue that we are taxed too little. Well, it looks to me that you'd need to raise all taxes (not just income taxes) by about 50% to balance the budget.

- I tend toward the "we spend too much" and it looks to me that you'd need to cut ALL (Social Security, Medicaid, etc included) spending by 33% to balance the budget.

- Your choice! OUCH!!!

- Either way we are in a very tough spot...we are borrowing every dollar it takes to operate the Federal Government on a day to day basis because each and every tax dollar going into DC goes right back out to support Mandatory Programs.

- Folks, it is what it is. I am merely making an observation of fact. Now, I'm sure that some are getting highly emotional right now. I choose not to. Instead, I will pray for leadership that will deliver a balanced budget each and every year...that's all it takes. Enforcement mechanism? CONgress and President would have their retirement payout delayed by three years for every 1 year of no balanced budget. Betcha they'd be some motivated Mofo's then!

- The longer we wait the tougher it will get since the interest expense will increase as we move away from these historically low interest rate times.

- PS...JUST A REMINDER...this does NOT reflect the Obamacare spending increases that will suddenly show up in 2014...which would require even higher taxes or even larger spending cuts to pay for. Hallelujah....Thank you Nancy Pelosi and Harry Reid for shoving this up our...constituency.

- So, next time you here President Obama call for sacrifice in the face of this budgetary mess just ask yourself this question aloud, "Why does he intend to go ahead with a ton of new spending when we can't afford our current programs? Why isn't he willing to sacrifice his 'legacy' as the nationalized healthcare President?" Oh that's right, when he says sacrifice that's just code for you pay more taxes.

- Below, long term outlook from OMB (Office of Management and Budget). Do you think this will get easier by delaying necessary action? Or that it will magically correct itself? If so, you must also believe in unicorns that crap Skittles (taste the rainbow). I do not.

- This is not an issue of political ideology. It is just simple math.

- To those politicos that claim to bring bold new initiatives and "change", they had better get on it!

- "Don't ever let a crisis go to waste"??? Well, here it is.

- Interesting test...Are you a Conservative, Liberal or Libertarian?

- "What? You expected me to actually know what I'm doing?"

- FOMC Meet ends today followed by interest rate decision and first ever Press Conference.

- Will make for typical stupid wild intraday moves...a day for research and laundry?

- Market continues to hold above guides.

- Market above all MA's and trying to turn back up.

- Things in the back of my mind...QE2 slated to end in JUN. When QE1 ended in MAR 2010, the market ran out of steam and ran into trouble.

- Good luck!

- Cartoon above sums it up. Both parties are just as bad.

- There are choices that must be made. Politicians are incapable AND unwilling. They always want to kick the can down the road and let the mess blow up on someone else's watch so they can be 'heroes' in the now with little concern for the consequences of their inaction.

- It's time to play the hand we're dealt and stop praying for four aces...that we know won't come!

- Want a real crisis to fix? Fix this one...it is real! Global warming hysteria has nothing on this one. (By the way, "evidence" of global warming on Pluto, Mars, Neptune and Jupiter. Yup! Must be man made...no doubt...no doubt at all!) Or, perhaps, as we enter a new solar minimum maybe we are headed toward a new "Little Ice Age". Folks, the science is not settled on this stuff. It appears to be agenda driven news. 'Nuff said!

- Need some more convincing, try this for starters....

- Each day our nation borrows $4 billion, or 42% of each dollar spent, not each dollar authorized. And, each day our nation pays communist China $73.9 million in interest on our debt, money that is allowing them to aggressively modernize their military, support a larger force and increase their global influence. We pay them enough in daily interest to buy a new jet for a carrier while we do not have enough planes for our own fleet.

- Me thinks that's silly....just saying.

- Ahem...when you make an investment, you should do so only upon expectations of a positive return. No?

- Check above chart for Federal level education expenditure increases versus 'reading, math, science test scores'.

- Investment? I don't see it. Seems more like pushing on a string and wishing.

- Answer one simple question..."How is it that we launched the entire computer / internet age while spending was so relatively low in the 1970's?"

- Simple answer...progress comes from innovative ideas and persistent effort to bring those ideas to fruition. It doesn't come merely because we haphazardly throw more money at it (ie, Bachelor's degrees in History of Western European Art, etc).

- Government should perhaps get out of the way and let folks, instead, "pave the way" through their creativity and dreams...which happens naturally as part of the human condition that seeks improvement and doesn't cost anything.

- And THAT only happens at the individual level...not as a collective (ie, failure of communism / socialism through the ages).

- Just saying...

- Curious about what your taxes pay for...specifically? Click here, put in the numbers and get a breakdown! Eye opening.

- Or, try this one.

- Or, this one.

- Sooo...with all the hullabaloo regarding the recent $38 billion cut deal ("largest in history"), the inescapable TRUTH is revealed in the chart above from the Congressional Budget Office.

- Conclusion? Even with the "largest cut in history", we still have a year over year increase in spending.

- What a crock. Folks...don't buy the hype. Question everything!

- I can hardly wait for our Fabricator in Chief, who incidentally promised 2 years ago to halve the annual deficit by the end of his first term, to throw a whole lot of generalities out there with no specifics and promptly run back to his corner for cover. Afterall, he wants to stay above the fray and avoid the heat of "true leadership".

- No doubt, he will pound the table for tax hikes...right on top of the tax hikes occurring at the state level. Doesn't sound like a good idea to me.

- Give more tax money to Congress and it will just be spent. Doubt it? Remember in 1983...the Social Security payroll tax was raised and was supposed to keep Social Security "secure for the next 75 years!" Well, its been less than 30 years and where's that money? GONE! SPENT! You're Social Security is blowing up AGAIN! Washington DC's answer...MORE TAXES!

- Please, don't fall for the obvious destructive cycle of "politicians overspend and taxpayers must be punished through automatic tax hikes" nonsense. Because, that's all it is.

- Hey ...I know! Why don't we try something novel for a change...REAL enforceable spending cuts. When regular folks run up their credit card, they don't claim their income is too low and look to take someone else's income to pay down the card. They spent too much...they know it...and they take the real world step of reducing spending.

- After a few years, then we can revisit the tax side of things. Unless, of course, you want to eliminate the entire current tax code (which just gives power to politicians and money to lobbyists) and institute the Flat Tax proposal. That way the populace would be able to clearly know what they are paying and Congress couldn't continue to nickel and dime us with new fees while increasing income taxes, too.

- WHOA...Absolute crazy talk!

- Ugghhh! Gasoline, after an almost 20 cent rise in the past 2 weeks alone, is just 10% below its 2008 highs.

- Well, it seems that the Federal Government, so far, remains open. The deal passed late Friday evening still has to be voted upon though. Additionally, the next hurdle is the Debt Ceiling hike (which they will do) that will be up for vote within the next few weeks. Soooo...you never know, we may just get a shut down anyway. If that happens, folks may realize just how readily life goes on...picnics, puppies, parties, etc.

- The deal? Being portrayed as "historic cuts"...~1%. Baby steps? Especially, when compared to annual spending in the graphic at the bottom.

- Sen. Harry Reid's absurd claim that "Republicans are holding Women's Health hostage over this deal" was completely laughable. What a red herring! Really, Harry? Honestly? We're supposed to believe that if the Republican proposal had been passed in its entirety that the Federal government would then have put forth an edict outlawing any and all physicians to treat 50% of the population? Stop spouting the even-less-than-half truths, Harry! Heck, we pay you darned good money. You could at least do your job and give us complete half-truths. And, that you think the American people are that vacant and outright stupid is, frankly, insulting!

- Politically speaking, watching how Congress deals with the 2012 budget and out years is going to be an absolute circus side show leading into the next Presidential election.

- What's really sad is that I trust that you and I could put an effective budget together over a weekend and a few beers. While we would no doubt disagree on some things, I think we could work it out and still have enough time and beer to genuinely enjoy the rest of the evening after a job well done. Your thoughts?

- First thought that immediately jumps out, for me, looking at the graphic below...immediately roll back spending to 2007 levels. That would be the starting point from which all negotiations would begin...it would not be the end point.

- EVERYTHING is in...including Social Security & Medicare! The elder generation of a society are the experienced ones having responsibilities to exercise and yet they still allowed this to happen over the past 2-3 decades (ie, looked the other way instead of meeting their civic duty) while many of us were but children. And now they, not all, appear ambivalent to robbing from the futures of children and grand children (what happened to ye 'ole, "It's for the children" mindset)? I say "No Dice!" We all take a hit and us younger folks will get an even bigger hit spread out over the long run...thanks! Besides, there weren't any COLA increases for the past two years anyway...you'll just lose one COLA hike, afterall.

- For those politicos wailing that's not right...OK, then! We'll roll back the spending levels to the last time you claimed "Nirvana"...the Clinton years! Game? No? Then go sit down, take a few deep breaths and then you can come back to the group when you are ready to act like big boys and girls.

- We've got real work to do!

- Ooops! Bill Gross (PIMCO), the biggest bond fund manager in the world, is not buying US Treasuries and is instead positioning himself to make money on the downside (ie, expecting interest rates to go up). That can't be good.

- Well...today's the day! To shutdown or not to shutdown, that is the question. History of shutdowns shows that it really isn't that uncommon...nor a big deal. It's just political Kabuki Theatre. So, enjoy the silly show...some call it a comedy others a tragedy.

- As to the markets. Not much to say. Gone sideways in a very tight range for the past five days which doesn't yield a whole lot of clues.

- Noticed today that Democratic leadership is slamming Paul Ryan's budget plan because "it lacks specifics". Also, what stands out is that they don't bring any solutions to the table either (ie, specific spending cuts). Perhaps, they should consult the Blue Dog Democrats (prior post)....GO DOGS!

- One question...exactly how much did the public know about the Health Care plan before it was enacted? You know, speaking specifically of course.

- Did I miss anything?

- Great summary of the "budget cuts" being argued to the death on the Hill...'cuz we're still screwing around with 2011's budget since the Democrats didn't even write a budget for it as required last year.

- Perhaps, Congressional pay for performance? Don't do your job...don't get paid? You know...like the rest of the world!

- Today Representative Ryan's budget gets revealed for 2012. Looking forward to the proposal to reduce $4 trillion over 10 years when they can't even cut $60 billion for one year.

- Anyways...below a graphic of the intent of Paul Ryan's plan.

- Market still up above MA's. Getting a bit stretched short term. Check the charts in the side bar.

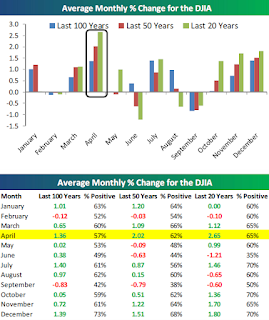

- Above...just for grins...seasonality for month of April. Looks like a good one.

- And, in the spirit of the non-existent "one-handed economist" that Harry Truman wanted...

- Below...is the market overvalued?

- You can read the whole article from dshort.com here.

- Way below...But it can always keep going up for awhile...especially with propping by the Federal Reserve via QE as we've seen. Who knows when that stops? But can't help what wonder what happens to the stock market when it does end (MAY 2010?).

- The above is not meant to single out teachers. Having said that...

- Public pensions are out of hand. A retired teacher in California gets as much as the national average of working teachers? Recently, I've read many recent articles of police and fireman getting 90% of their pay (gets conveniently spiked by overtime in the last year or two).

- Let's look at a military retiree...there is no overtime, suffers extra costs (and lost spousal income) throughout career due to forced multiple moves (average every 3 years), allowances are stripped out for retirement pay calculation and only base pay is used resulting in less than the advertised 50% of their last pay that many folks think they get...closer to 35% for some after the reductions.

- When public employee retirements fall in the more appropriate range of the military retiree, I think that would be a good starting point for future discussions.

- Until then...meh!

- HAT TIP TO THE BLUE DOG DEMOCRATS...Benchmarks for Fiscal Reform!!! (click to read)

- GO DOGS!!!

- Honestly...no clue. It was a swift down once first support (1290) broke and it is just as quickly back above it.

- Above all moving averages (good) and trying to push through the congestion area to the left.

- The MAR down move pushed down to reveal a parallel channel line (drawn today) compared to the rising wedge shown on previous posts with this chart (17 MAR).

- Day by day.

- Below, impact by sector for unemployment (jobs) during the recent recession.

- The Libyan situation is not funny. BUT...

- Absolutely hilarious watching both parties attempts at rationalization / justification for political advantage. Which definitively proves that both parties are the same...only the times and faces/names change.

- I hope that you hardcore supporters of either party take the time to actually THINK about that. And then, I hope that you pause, use your mind, contemplate deeply and throw off any allegiance you hold to either party...forever...PERIOD. Become Independent yourself! Instead, seek what's best for the country in the long run and support / vote for leaders who are willing to do the hard work to take us in that direction. We have enough issues right here, right now that require our immediate attention. We need to avoid all distractions, focus like a laser and fix what ails our nation NOW...excessive government spending and using debt to do it! To continue down this path locks in lower living standards / higher taxes for our kids and grandkids. No reasonable (keyword there) adult would selfishly pass their burdens to their children, yet that is exactly what is being done. The clock ticks....and we still waste time and resources on the unimportant.

- Don't think it's the spending? OK...try this scenario then...remember President Obama's Stimulus in 2009 that was a $787 billion hodge podge of spending steered toward political interests by the politicians in Washington DC? Good...alright then...please sit down for this. Did you realize that total income taxes paid to the federal government in 2009 were $1,054 billion? SOOOO....this means that they could have reduced those taxes by approximately 75% and had the same stimulative effect of returning money to the economy...only YOU would have determined how your money was spent. Which would you have preferred?

- Anyway, back to Libya: My opinion...and I know it is just that, an opinion...is that we've no business there. There is no imminent threat to the US.

- Besides, I think I read somewhere that, "Governments long established should not be changed for light and transient causes; and accordingly all experience hath shewn, that mankind are more disposed to suffer, while evils are sufferable, than to right themselves by abolishing the forms to which they are accustomed. But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security."

- Silly me...that's right...that's from our very own Declaration of Independence! It's their right in Libya. Not ours to meddle in their affairs.

- USA needs adult leadership...and NOW!

- UPDATE 28 MAR: Oh...and it just gets better...Libyan rebel leader admits ties to Al Qaeda and having fought against the US in Iraq.

- The bounce continues....we're right at the 20 & 50dMA's. Plus, price is at the late FEB-early MAR price congestion area. We're still above the 90dMA which is a plus.

- So, we should find out over the next few days whether the upmove resumes or not. I have no preference which way, as I could make an argument for both.

- Of course, Da Boyz are back to their old games (chart below demonstrates)....yesterday's big up move was a result of a 20 point gap up opening (all overnight action) and then it chopped around in a feeble 5 point sideways range the remainder of the day. They are good at trapping both sides, bulls and bears.

- One day at a time.

- Below, gaps from Friday's close to Monday's opening since 2000. Notice any difference?

- While many are tilting against nuclear power due to the risk of fatalities, let's first take a breath and then look at the facts.

- Above is a chart of the number of deaths per Terawatt hour associated with various sources of power generation for your consideration.

- Below, another item that gains interest occassionally...Water scarcity.

- No inflation my ass!

- Don't know what kind of crack the Fed is smoking. Perhaps they should "Just say no!"

- Check out the energy and education components. Mini-rant...largest component of education expense...Hmmm, teacher salaries perhaps? And the results? I'll just let you connect the dots there.

- You can click on this to open a new window that allows you to click links at the top to look at the entire series.

- And, for perspective regarding ridiculously escalating education costs...you thought housing was a bubble??? If so, what are education cost increases? Put quite simply, a nightmare!!!

- UPDATE with some interesting charts below...

- The Federal Reserve's QE2 was announced in AUG 2010 and actual purchases of US Treasuries began in NOV 2010.

- The CPI, below, indicates an over 5% annualized rate since NOV.

- That impacts consumer purchasing power. For example, below is a chart of real wages (wage changes less inflation rate). Notice how real wage gains are negative toward the end of 2010. Dunno about you, but that doesn't seem good to me.

- Next, below, is the Producer Price Index (PPI). This is the price rate of change that producers are experiencing in order to get the materials needed to make their goods which they, in turn, sell to you.

- Last year, their prices went up 5.8%. Last month their prices went up over a 20% annualized rate. That is inflation in the pipeline on its way to consumers. Also, notice the trend since AUG (QE2 announcement).

- What if producers can't push all the increase through to a retrenching consumer? Profit margins are vulnerable which could weigh on their stock prices.

- In summation...not pretty! Not at all.

- Welcome back to the 1970's???

- I sure hope disco doesn't come back!

- There's still a chance that this is a temporary spike as QE programs are showing they're really not improving the economy much. What if the economy rolls over again even with QE? That's deflation.

- Well, 2011 certainly is shaping up to be a wild year with political, natural and market events!