skip to main |

skip to sidebar

- I just spent a long weekend with special folks in Washington DC. It was a wonderful weekend with folks who are very serious when they come to their hopes and dreams for our country. They were amazingly specific and articulate with regard to ideals and vision.

- It's truly unfortunate that more than half of our country that claims to have a better "vision" has never bravely stepped up to the plate and offered "everything" like my friends who have served or like those that in fact gave "their all" in service of country.

- My closing thought...."Words come cheap. Measure a man (woman) by their deeds."

- If the above concepts offend you....I'm glad. It means that freedom of speech is still a right.

- Perhaps, the discussion may cause you to actually consider reality vice a fantasy world of perfection that never will exist in this world...but will in the next.

- Not much of a week. Sunday, 15 MAY post still applies as far as I'm concerned. Although, we did post the first lower high and lower low in quite some time....something to note.

- Here's a chart I saw from the author of this website...http://channelsandpatterns.blogspot.com/

- That bottom up trendline is still holding and, interestingly, it's about the same spot as the 90DMA (discussed last Sunday). You can check the charts in the sidebar.

- PS...my computer was struck by lightning / replaced a few weeks ago and I upgraded charting software and am still banging around trying to learn parts of it including chart captures. Almost there....glad I have those charts in the sidebar for those interested!

- Well...I'm still here! Guess I'm a bad person or nothing happened.

- Psst....nothing happened, nothing was going to happen and nothing happened.

- It'll happen when the entire world is in large part unprepared for it...IMHO.

- Moving right along....

- Well...today is The Rapture...or not. Supposed to occur at 6 PM today.

- So, I'll just put this up as my potential final post...

- "Good Luck" to the rest of you left behind and reading this!

- Interesting graphic on duration of bull and bear moves in a secular bear market above. Or, just another thing that makes me nervous.

- Article on just how broken Social Security is. Requires an immediate and permanent tax hike of 2.15% or benefit cuts of 13.8%. This is not going to be easy and it will be something to watch and see how Congress handles it.

- 20 surprising statistics regarding the housing market. It's not getting better. At least, we are closer to the end of the down. Problem is that it is as slow moving as a glacier.

- Like being at a horror flick.

- "Up yours Wall Street!" I love it.

- What a crazy week with multiple margin hikes across various commodity sectors which completely annihilated some folks, no doubt. Just another demonstration how the game is rigged. Anyway...

- On the daily, stock market is now sideways as far as I'm concerned. Could go either way or just screw around for awhile. Check the charts in the sidebar. It was a screwy week and a major bull bear battle is going on. I prefer to avoid these clash of the titans.

- So, instead...Sunday reads for your consideration if you are only bullish, this may present some thoughts for your consideration. It is sideways, and I have no clue. All I can tell you is that I didn't see any clear situations at all last week. Anyway, here ya go...

- Possibility of a market top?

- Bernanke...meet Mr. Rock and Mr. Hardplace.

- Pros are buying puts...comparitive history.

- Possible warning signs.

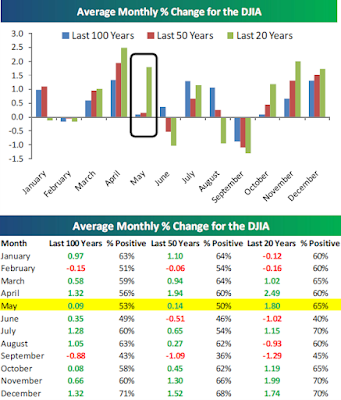

- None of the above means that it goes down immediately. Add in the old "Sell in May and go away" or, sentiment picture from my last post or, QE2 goes away in JUN 2011 (QE1 went away in MAR 2010....see how that went), and it all makes me very nervous right here.

- What I can tell you with complete certainty is that I will not be long if the market crosses the 90 DMA to the downside and stays below it...no matter what until the Fall. Above it...consideration will perhaps be taken. But, I will not tolerate below it, at all.

- One more reminder for our recent and future college grads regarding tuition costs...you had better think long and hard about your choice of majors, below...

- The College Debt Bubble conspiracy.

- Uh...above continues to be a concern...high bullish sentiment. You can judge for yourself. It may not be done but it has persisted for awhile which is something to note.

- Daily chart has taken its breather and can rally while the weekly chart does look toppy. But, price remains above all moving average guides. You can check the charts in the side bar.

- Perhaps the "Sell in May...." mantra will play out?

- With the news of Osama Bin Laden, I hope the media drops it as quick as it dropped 911 coverage.

- In my opinion, it is important that they do because we don't need ANY distractions from the very critical stuff we are currently facing at home here in the US. Of course, the cynic in me says that the politicos want this distraction and they created it for this very moment in time.

- But to depart on a positive note...does the bottom cartoon hold any promise for the future? I hope so.