skip to main |

skip to sidebar

29 AUG 2011, Monday (AM)

- Volatility still high, starting to come down a little. Friday was crazy due to the Fed talk at Jackson Hole. No surprise there.

- Daily, top, has been going sideways. May try to get above it's 20MA this week and challenge the recent swing high...possibly the swing lows from the spring?

- Weekly, bottom, short term momentum indicators are just turning up.

- So, maybe we start to see more of a bounce for a few weeks to mid 1200's but I'm thinking that it will be very choppy similar to what happened after the Flash Crash 2010. That's the environment. For the nimble, no doubt.

- Back drop of European nonsense is keeping a high level of uncertainty as well.

- It will be thin trading, too, as many will shorten their week to bug out early for the Labor Day weekend.

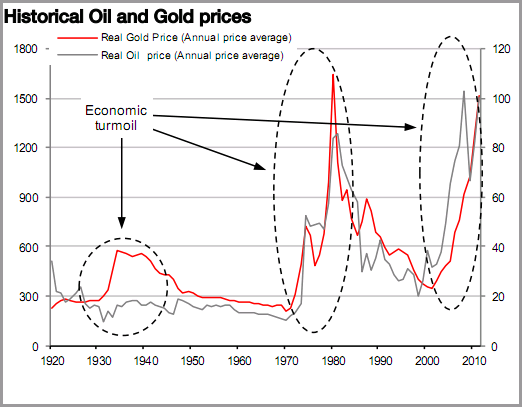

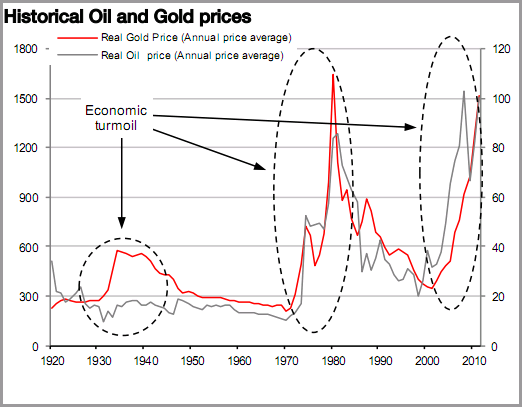

- Below, interesting historical view of crude oil and gold...indicates that commodities prices may have seen the bulk of their run or put another way "the easy money has been made". They can continue to go up but not at the rate they have. And if we go into recession, which it seems we're tipping toward, demand will decrease and their prices will fall. This could put a dent in the hyperinflation theory. And here is another counterpoint to the hyperinflation theory. If anything, imploding financial systems and several sovereign nations defaulting on debt would be deflationary for the overall world economy as it would result in a retrenchment of economic activity for many nations at once (ie, 1930's)....just my opinion.

- And this is hardly inflationary...US Government / FHA largest owner of foreclosed real estate tries to move properties without swamping markets. Supply = monstrous, Demand = non-existent. Just ask anyone who's been trying to sell a house. Not inflationary!

No comments:

Post a Comment