skip to main |

skip to sidebar

14 MAY 2013, Tuesday

- Correlation does not necessarily equal causation but the above graph is interesting. Who's juicing this stock market the past few years when the economy is not? And, if the FED's operations are the only thing propping everything up, what exactly happens when the FED stops?

- And, who do you think will know first about when it stops so they can take appropriate protective measures...Da Boyz or you?

- Interesting and historical times.

- The FED's activities have distorted almost all markets to the point where true valuation and price discovery mechanisms are breaking down and just leave you scratching your head. One market...OK...I could understand one market getting temporarily dislocated. But, all the majors are convoluted...stocks, bonds, dollar, oil, gold. Price signals have been crushed. What do you trust? Or perhaps we're in a large transition moment for each of those markets at the same time. Will have to watch...one day at a time.

- Good read for more thoughts...5 Questions that Every Bull Market Should Answer

- The market is going up in any way you look at it. Currently, it seems like it only inhales and never exhales.

- Is the market going to correct soon or go parabolic? Will only know in hindsight...one day at a time.

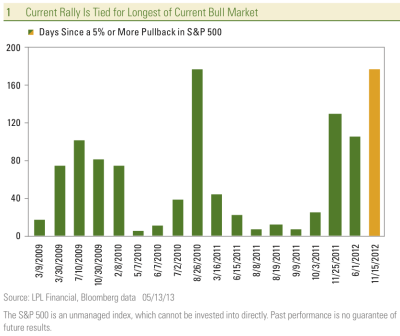

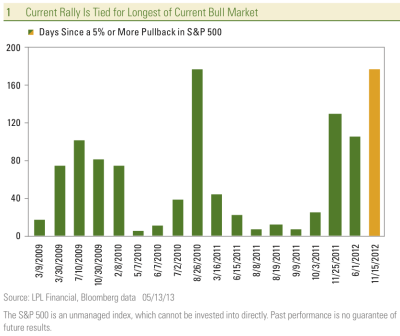

- Since this Bull run began in MAR 2009, this has been the longest run of days without so much as a 5% correction. Would be nice to see a little bit of a healthy breather for a while to allow it to reset.

- A little historical perspective. Again, it's still going up at this time.

.jpg)

No comments:

Post a Comment