skip to main |

skip to sidebar

28 JUL 2011, Thursday

- Government is (ie, spends) twice as big as it was 10 years ago. What have we got for that? A couple of protracted wars, a housing bubble, skyrocketing (7% annual increases) in college tuition costs...and not even a stinking t-shirt.

- Government is (ie, spends) 30% as big as it was since President Obama's inauguration. Because of the recession and unemployment, tax revenues (government income) went down.

- First, we're just spending too much.

- Second, if you were living paycheck to paycheck, would you increase your spending by 30% if you your income was cut by 15%?

- The math says you can't do that for long. And, it's all about the math...not, about what you wish you could do.

- With yesterday's drop, SP500 currently below all MAs (20/50/90)...risk increases below the 90. Reason, all bear markets go below the 90...BUT, just as a reminder, not all moves below the 90 turn into bear markets. You can check the charts in the sidebar.

- Below, update to the similarities between the current top and that of 2007....very interesting...doesn't have to play out the same but it sure is eerily similar. But, hey, anything can happen...debt ceiling vote saves the day? The news has been non-stop lately...makes it very difficult.

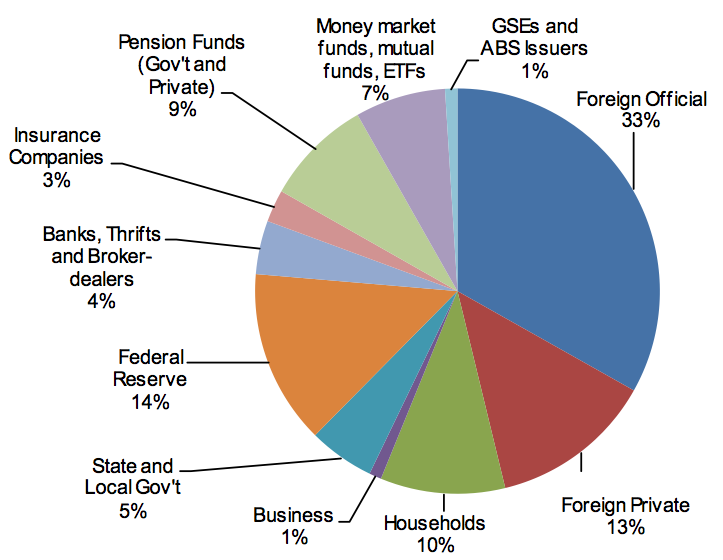

- Who owns all the federal Treasury debt anyway?

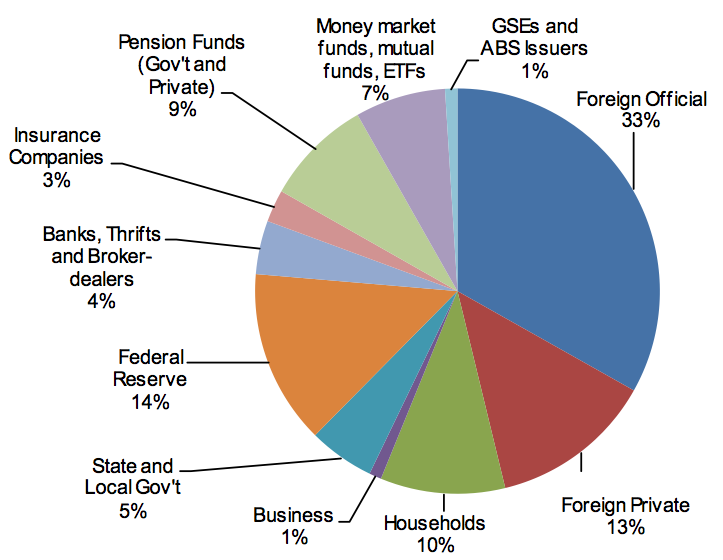

- Where does the big money go? Just wanna highlight...even with several protracted military adventures, what consumes the big percentage? There won't be much of a "peace dividend".

No comments:

Post a Comment