skip to main |

skip to sidebar

14 OCT 2011, Friday (AM)

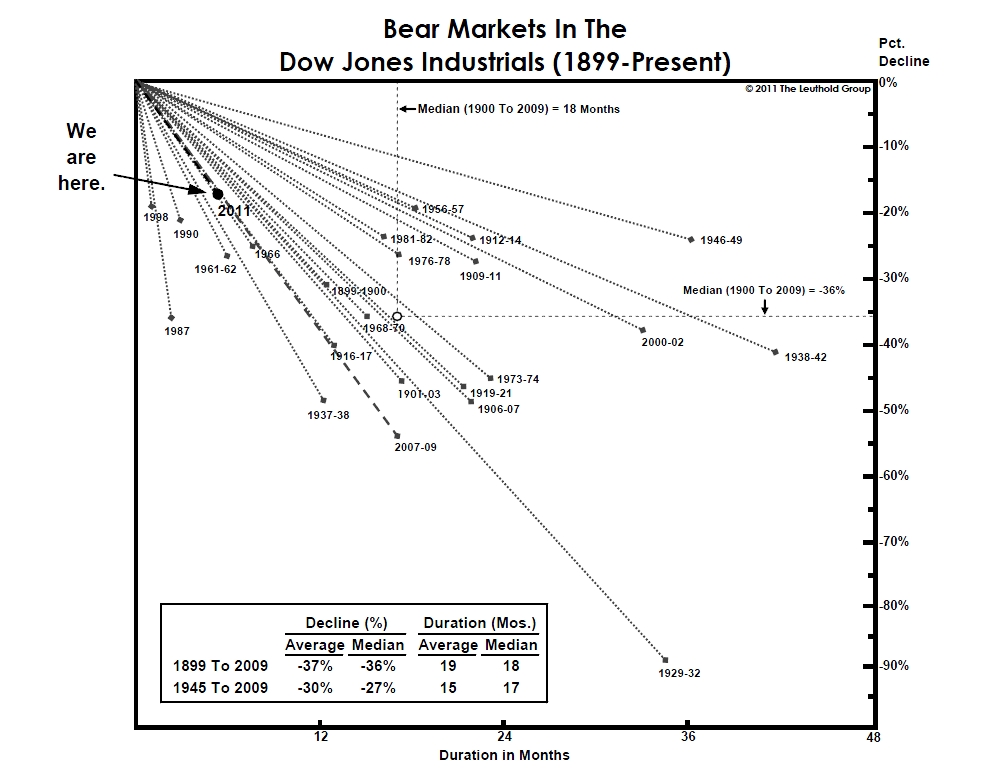

- Interesting graphic above regarding duration and extent of historical bear markets for future reference.

- Below, market is short term overbought. Due for some consolidation, retracement at least.

- Honestly, it's in a position where it can do almost anything since there is no real market structure to work from beyond the continued large sideways band. Only thing going for it is that it's above its 20 & 50MAs. But, still below the 90 & 200MAs. The following action will have to provide additional clues.

- It is very news driven (ie, Europe) and volatile...and, now, it's earnings season as well. Upcoming news in November will be the debt ceiling again and the Congressional Super Committee findings.

- And one final thing to consider, it appears that we are rolling over into a new recession based upon leading indicators and stocks don't tend to do well then.

No comments:

Post a Comment